Kickbacks in healthcare represent a significant concern for both the integrity of medical practices and the trust that patients place in healthcare providers. These illegal financial incentives can compromise patient care, inflate healthcare costs, and distort medical decision-making. For healthcare professionals, patients, and especially whistleblowers, understanding what constitutes a kickback is crucial for maintaining ethical standards and promoting transparency in the healthcare system.

What Are Healthcare Kickbacks?

A kickback in healthcare occurs when a provider or entity receives payment or other forms of remuneration in exchange for referring patients, prescribing specific medications, or recommending particular services or products. Unlike other types of healthcare fraud, which might involve billing for services not rendered, kickbacks specifically involve a quid pro quo arrangement—essentially, “you scratch my back, I’ll scratch yours.” For example, a laboratory might pay a physician for each patient referral, or a pharmaceutical company might offer financial incentives to doctors who prescribe their drugs more frequently, regardless of whether those medications are in the patients’ best interest.

Legal Framework Surrounding Kickbacks

The primary law governing kickbacks in healthcare is the Anti-Kickback Statute (AKS). The AKS is a federal law that prohibits the exchange (or offer to exchange) of anything of value to induce or reward referrals of federal healthcare program business, including Medicare and Medicaid. Violating the AKS can result in severe penalties, including hefty fines, exclusion from federal healthcare programs, and even imprisonment.

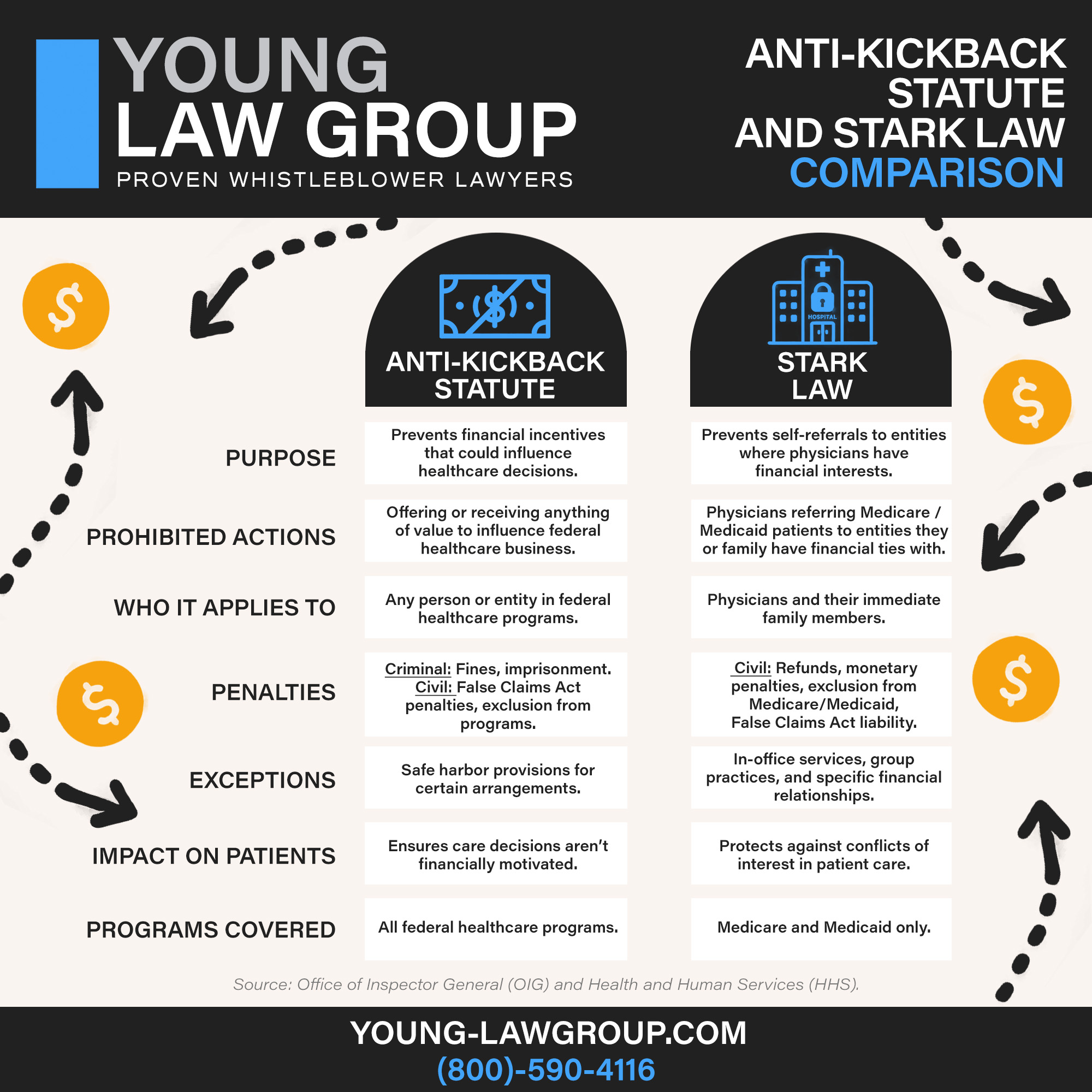

It’s important to distinguish between the Anti-Kickback Statute and the Stark Law, which also addresses financial relationships in healthcare. While the Stark Law specifically prohibits physician self-referrals—where a doctor refers patients to a medical facility in which they have a financial interest—the AKS is broader, covering any arrangement that might unduly influence a provider’s decisions.

How Kickbacks Affect the Healthcare System

Kickbacks can have profound negative impacts on the healthcare system. They often lead to increased healthcare costs, as providers may order unnecessary tests or prescribe more expensive medications to receive a financial benefit. This not only burdens the healthcare system with unnecessary expenses but also can result in patient harm if they undergo unwarranted procedures or are given inappropriate treatments. Furthermore, kickbacks undermine the trust that patients place in their healthcare providers, as decisions may be influenced more by financial gain than by medical necessity.

Identifying Kickbacks: Signs and Red Flags

Recognizing potential kickbacks requires vigilance and awareness of common red flags. For example, if a provider frequently refers patients to a particular specialist or laboratory without clear justification, or if there are unusually high rates of certain expensive prescriptions being written, these could be signs of a kickback arrangement. Other red flags might include receiving unrequested gifts, lavish meals, or “consulting fees” that are not commensurate with the work performed.

Healthcare professionals should be aware of these signs and conduct due diligence to avoid inadvertently participating in illegal activities. Being proactive in understanding these indicators can help maintain ethical standards and prevent involvement in fraudulent schemes.

The Role of Whistleblowers in Exposing Kickbacks

Whistleblowers play a critical role in identifying and exposing kickbacks in healthcare. They are often insiders—employees or associates of healthcare organizations—who have firsthand knowledge of unethical practices. Whistleblowers can report these activities under the False Claims Act (FCA), which allows individuals to sue on behalf of the government if they have knowledge of fraud against federal programs. Whistleblowers can receive a percentage of any recovered damages as a reward, providing a strong incentive for coming forward.

Importantly, the FCA also includes provisions to protect whistleblowers from retaliation by their employers, such as termination or harassment, ensuring they can report wrongdoing without fear of personal retribution.

How to Report Kickbacks: A Step-by-Step Guide

If you suspect kickbacks in your workplace, the first step is to document all relevant information carefully. This may include emails, financial records, witness accounts, or any other evidence that could support your claim. Consulting with an attorney who specializes in healthcare fraud and whistleblower laws can provide guidance on how to proceed and ensure your actions are protected under the law.

Next, report your concerns to the appropriate authorities. This could include the Office of Inspector General (OIG) of the Department of Health and Human Services (HHS), which investigates healthcare fraud, or directly filing a qui tam lawsuit under the False Claims Act. Your lawyer can help determine the best course of action based on the specifics of your case.

Conclusion

Kickbacks in healthcare not only violate legal standards but also compromise patient care and the integrity of medical practices. Whistleblowers serve a vital function in identifying and reporting these illegal activities, helping to safeguard public health and ensure that healthcare decisions are based on patient needs, not financial incentives. By understanding the nature of kickbacks and being vigilant about potential signs, healthcare professionals can contribute to a more transparent and trustworthy healthcare system.

ANTI-KICKBACK STATUTE FAQ

- What’s the difference between the Anti-Kickback Statute and the Stark Law?

- What is a kickback in healthcare?

- What Are the Potential Criminal Penalties for Violating the Anti-Kickback Statute (AKS)?

- What is a Possible Penalty for Violating the Anti-Kickback Statute?

- Is the Anti-Kickback Statute Civil or Criminal?

- What Does the Anti-Kickback Statute Prohibit?

TYPES OF WHISTLEBLOWER LAW

- False Claims Act

- Contractors and Sub-Contractors Fraud under the Davis-Bacon Act

- Customs Fraud

- Education Fraud Under the False Claims Act

- Finance Industry Whistleblowers

- Empowering Environmental Whistleblowers for a Greener Future

- Government-backed Mortgage Fraud

- Safeguard Your Business from Procurement Fraud Risks

- Whistleblowing in Healthcare under the False Claims Act

- Nuclear Safety Whistleblowers

- Pharmaceutical Whistleblowers

- Small Business Contract Fraud Under The False Claims Act

- Transportation Whistleblowers

- SEC Whistleblower Program

- CFTC Whistleblower Program

- FIRREA Whistleblowers

- IRS Whistleblower Program

- Auto Whistleblower Program

- Class Actions

- Executive Compensation and Employment Law