What’s the difference between the Anti Kickback Statute and Stark Law?

Understanding the Anti-Kickback Statute

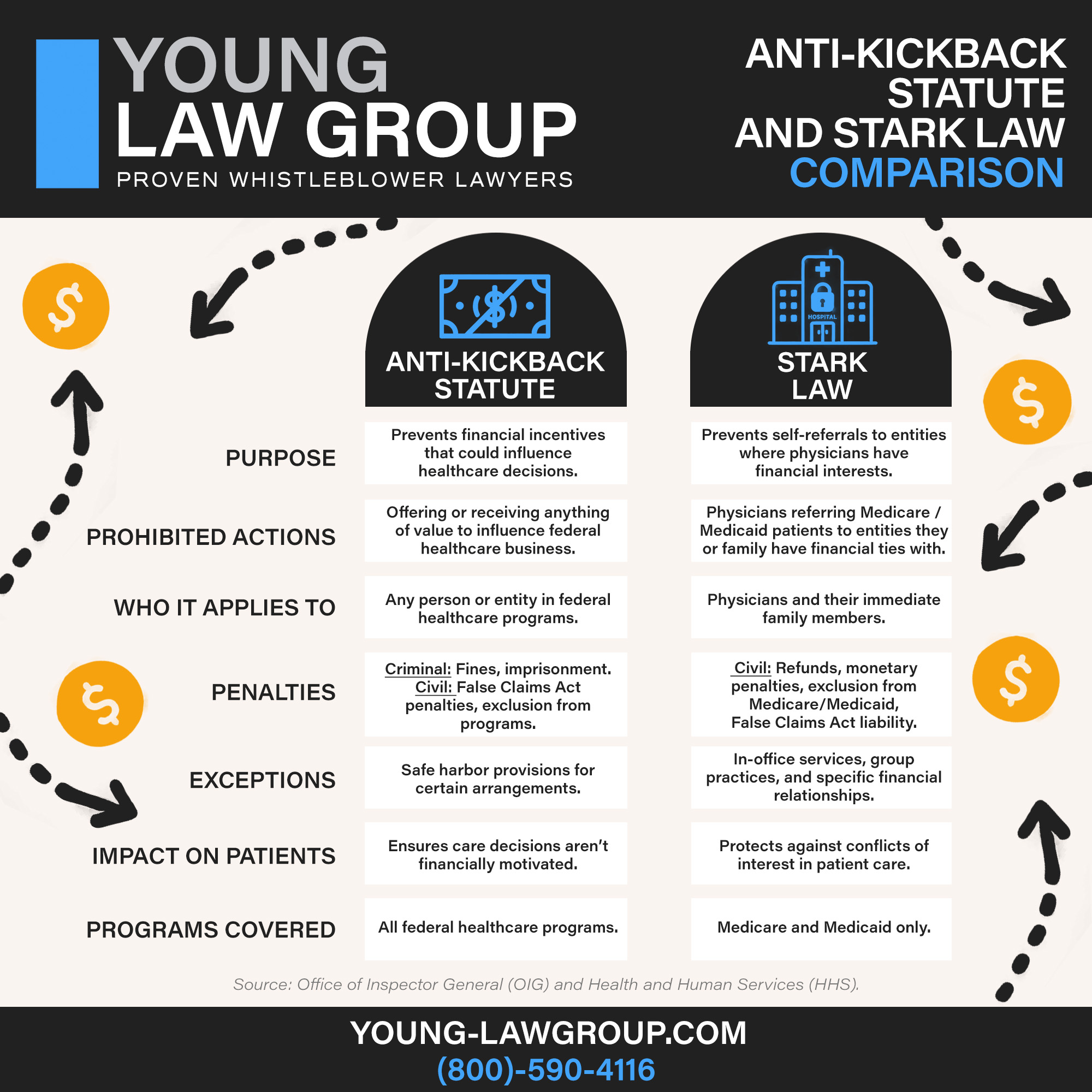

The Anti-Kickback Statute (AKS) is an essential federal law designed to combat fraud and abuse in the healthcare industry. It prohibits the exchange of any form of pay—whether it’s cash, gifts, or other incentives—in return for referrals of services or products covered by federal healthcare programs, such as Medicare or Medicaid. This law plays a vital role in ensuring that healthcare decisions are made based on patient needs rather than financial incentives.

The Anti-Kickback Statute is part of a broader effort to maintain the integrity of the healthcare system, protect patients, and prevent unnecessary costs to taxpayers. Violating the Anti-Kickback Statute can lead to severe penalties, including hefty fines, exclusion from federal healthcare programs, and even imprisonment.

Understanding Stark Law

Stark Law (also known as the Physician Self-Referral Law) complements the Anti-Kickback Statute by regulating physician referrals. Specifically, Stark Law prohibits physicians from referring patients to receive “designated health services” payable by Medicare or Medicaid from entities with which the physician (or an immediate family member) has a financial relationship, unless an exception applies.

Stark Law aims to prevent conflicts of interest that could result in over-utilization of services, higher healthcare costs, and compromised patient care. While both Stark Law and the Anti-Kickback Statute address improper financial relationships in healthcare, Stark Law is a strict liability statute, meaning that intent does not need to be proven to establish a violation.

Major Similarities Between the Anti-Kickback Statute and Stark Law

Both the Anti-Kickback Statute and Stark Law share the common goal of safeguarding the integrity of the healthcare system by preventing improper financial relationships that can influence medical decision-making. They aim to protect patients from potential harm resulting from conflicts of interest while promoting cost-effective care.

Moreover, both laws apply specifically to relationships involving federal healthcare programs, such as Medicare and Medicaid, ensuring that referrals and services rendered are based on patient needs rather than financial incentives. Additionally, violators of either law face stringent penalties, reinforcing the serious consequences of non-compliance in the healthcare sector.

Major Differences Between the Anti-Kickback Statute and Stark Law

While the Anti-Kickback Statute and Stark Law share similar objectives, they differ significantly in their scope and enforcement mechanisms. The Anti-Kickback Statute is more expansive, prohibiting any remuneration exchanged for referrals of services covered by federal healthcare programs, regardless of whether the services are medically necessary. It encompasses a broad range of financial relationships, including those outside the physician-patient context. In contrast, Stark Law specifically pertains to physician referrals for designated health services and does not require proof of intent, as it operates under strict liability.

Furthermore, Stark Law explicitly prohibits financial ties that influence referrals, while the Anti-Kickback Statute allows for certain safe harbors that can protect specific arrangements from liability. Consequently, the implications and compliance requirements of each law can vary significantly for healthcare providers and entities involved in service delivery.

Types of Kickbacks Prohibited by the Anti-Kickback Statute

The Anti-Kickback Statute broadly targets any arrangement where compensation is exchanged for referrals. Here are a few examples of kickbacks that violate the statute:

Healthcare Kickbacks

Payments to Doctors for Referrals

Physicians might receive financial incentives from hospitals, labs, or other providers in exchange for referring patients for services or treatments.

Pharmaceutical Kickbacks

Drug companies might offer incentives to physicians or pharmacists to prescribe certain medications over others, regardless of what is best for the patients.

Government Contract Kickbacks

Bribes for Contracts

Contractors might offer kickbacks to government officials in exchange for awarding contracts, a practice that is not only unethical but also illegal under the Anti-Kickback Statute.

Corporate Kickbacks

Vendor Kickbacks

Companies may offer payments, gifts, or other perks to decision-makers in other businesses in return for purchasing or recommending their products.

How the Anti Kickback Statute and Stark Law Protect Against Fraud

Together, the Anti Kickback Statute and Stark Law create a robust framework to combat healthcare fraud. They work hand-in-hand to eliminate financial incentives that could corrupt medical decision-making and ensure that healthcare providers act in the best interests of their patients.

Penalties for Violating the Kickback Statute and Stark Law

Violations of the Anti Kickback Statute can lead to severe penalties, including criminal fines of up to $100,000 per violation, imprisonment for up to ten years, and civil penalties under the False Claims Act (FCA). Stark Law violations can incur similar civil penalties, such as denial of payment for services, refund of payments received, and exclusion from participation in federal healthcare programs.

The Role of Whistleblowers in Exposing Anti-Kickback Violations

Whistleblowers play a crucial role in uncovering and reporting violations of the Anti Kickback Statute and Stark Law. These brave individuals often have insider knowledge of illegal activities and can help bring them to light, protecting the integrity of the healthcare system and saving taxpayers money.

Legal Protections for Whistleblowers Reporting Anti Kickback Violations

Whistleblowers are protected under the False Claims Act and other laws, which shield them from retaliation and offer the potential for financial rewards. These protections encourage individuals to come forward and report fraud without fear of losing their jobs or facing other forms of retribution.

Financial Rewards for Whistleblowers

Under the False Claims Act, whistleblowers may be entitled to a significant portion of the recovered funds—sometimes as much as 30%—as a reward for their role in exposing fraud.

At Young Law Group, we specialize in representing whistleblowers in Anti-Kickback Statute and Stark Law cases. Our experienced team offers confidential consultations to discuss potential violations and guide clients through the reporting process. We prioritize your confidentiality and are committed to protecting your rights while providing the support you need. Contact us via phone, email, or our secure online form to learn more.

ANTI-KICKBACK STATUTE FAQ

- What’s the difference between the Anti-Kickback Statute and the Stark Law?

- What is a kickback in healthcare?

- What Are the Potential Criminal Penalties for Violating the Anti-Kickback Statute (AKS)?

- What is a Possible Penalty for Violating the Anti-Kickback Statute?

- Is the Anti-Kickback Statute Civil or Criminal?

- What Does the Anti-Kickback Statute Prohibit?

TYPES OF WHISTLEBLOWER LAW

- False Claims Act

- Contractors and Sub-Contractors Fraud under the Davis-Bacon Act

- Customs Fraud

- Education Fraud Under the False Claims Act

- Finance Industry Whistleblowers

- Empowering Environmental Whistleblowers for a Greener Future

- Government-backed Mortgage Fraud

- Safeguard Your Business from Procurement Fraud Risks

- Whistleblowing in Healthcare under the False Claims Act

- Nuclear Safety Whistleblowers

- Pharmaceutical Whistleblowers

- Small Business Contract Fraud Under The False Claims Act

- Transportation Whistleblowers

- SEC Whistleblower Program

- CFTC Whistleblower Program

- FIRREA Whistleblowers

- IRS Whistleblower Program

- Auto Whistleblower Program

- Class Actions

- Executive Compensation and Employment Law