The History of the False Claims Act

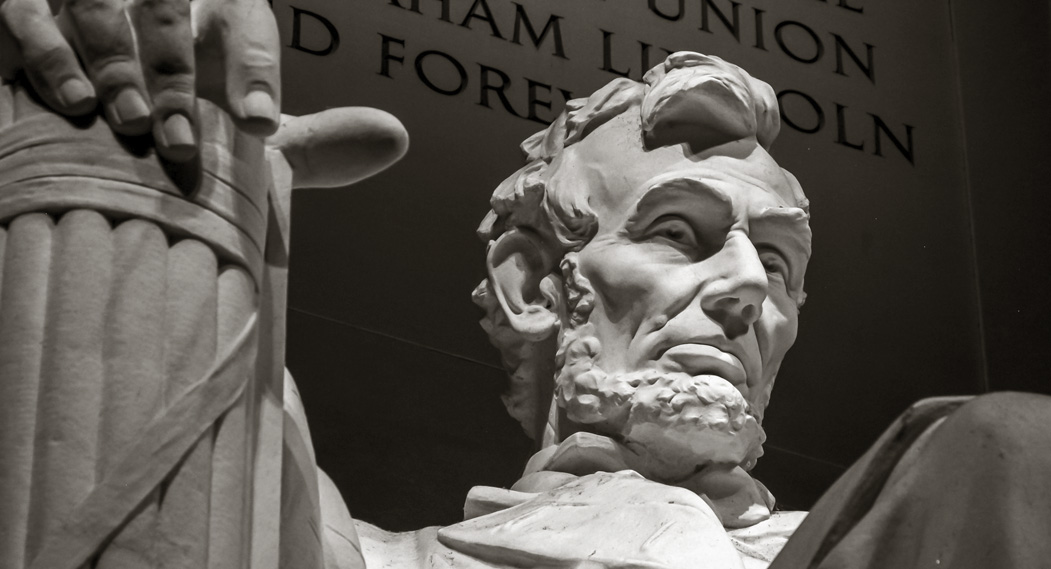

The False Claims Act was signed into law by President Abraham Lincoln during the Civil War. It was enacted so that the federal government had a means to sue unscrupulous merchants that sold substandard and defective goods to the Union Army. The False Claims Act has been amended several times since its enactment. The most significant amendments occurred in 1986 which allowed the government to seek treble damages for violations of the Act. The 1986 amendments also significantly increased the monetary incentives for whistleblowers.

The False Claims Act authorizes a private individual, known as a “relator,” to bring a cause of action on behalf of the United States government to recover monies lost due to fraud or related misconduct. A lawsuit filed under the False Claims Act is known as a qui tam action, a legal concept that first originated in England. If a relator is successful in a qui tam action, they are entitled receive a percentage of the recovered proceeds.

In Fiscal Year (FY) 2022, the Department of Justice (DOJ) recovered over $2.2 billion from 351 civil settlements and judgments in False Claims Act cases. Of the more than $2.2 billion recovered, over $1.9 billion came from lawsuits filed by whistleblowers under the qui tam provisions of the False Claims Act. Since the False Claims Act was amended in 1986, the government has recovered more than $72 billion.

Filing a Complaint Under the False Claims Act

The process begins when a qui tam complaint is filed under seal in federal district court. Unlike most complaints in civil lawsuits, a complaint filed “under seal” means that it does not become a matter of public record. Only the relator, the relator’s attorneys, and DOJ attorneys have knowledge of the existence of the complaint. By maintaining such confidentiality, DOJ staff can investigate the allegations in the complaint without the defendant’s knowledge.

A qui tam complaint is initially sealed for 60 days; however, experience has shown that the government rarely completes its investigation within the 60 day period allotted by the False Claims Act. The government can therefore petition the Court to extend the seal period so that it can continue its investigation and gather evidence.

Once the government’s investigation is complete, the DOJ notifies the Court as to whether it will intervene in the case. If the DOJ elects to intervene, it will prepare and file its own complaint in intervention. If the DOJ declines to intervene, the relator can proceed with prosecution of the case on behalf of the United States government.

There are certain situations where a relator is not permitted to file a qui tam action. A YLG attorney can help determine whether one of the following exclusions may be applicable to your case:

A relator is barred from bringing suit under the False Claims Act if they have been convicted of a crime for their role in the misconduct that is the subject of the lawsuit.

A relator is barred from bringing suit under the False Claims Act if they have been convicted of a crime for their role in the misconduct that is the subject of the lawsuit.

A relator is barred from bringing suit under the False Claims Act if they have been convicted of a crime for their role in the misconduct that is the subject of the lawsuit.

Biggest Offenders by Industry

Based on trends over the past decade, it came as no surprise that the healthcare industry was responsible for the overwhelmingly largest percentage of the recoveries — $1.7 billion of the $2.2 billion recovered.

Unscrupulous healthcare providers engage in a variety of deceptive schemes that ultimately result in fraudulent claims that are submitted to government healthcare programs, such as Medicare, Medicaid and TRICARE.

In FY 2022, healthcare companies, pharmacies and laboratories entered into settlements with the government to resolve allegations involving: substandard skilled nursing services in nursing homes; providing medically unnecessary medical services and surgeries; enrolling patients for hospice services who were not terminally ill; unauthorized switching to higher cost medications without medical need or a valid prescription; and billing for for unnecessary urine drug, psychological, and genetic testing.

When a federal healthcare program is implicated, the payment of kickbacks can potentially lead to False Claims Act violations as well as criminal liability. One such case involved a pharmaceutical company that paid over $843 million to resolve allegations that it paid illegal kickbacks to physicians who spoke at or attended programs involving certain of the company’s drugs.

In another kickback case, a durable medical equipment manufacturer paid more than $24 million to resolve allegations that it paid unlawful kickbacks to suppliers to induce them to select the company’s respiratory equipment. The company allegedly provided the suppliers with physician prescribing data at no cost even though the company knew that it was a valuable tool that helped suppliers market to physicians.

Fraud by defense contractors during the U.S. Civil War was the impetus for the enactment of the False Claims Act. More than a century and a half later, government contractors consistently remain near the top of the DOJ’s annual list of False Claims Act recoveries.

In FY 2022, a government contractor agreed to pay $8.4 million to resolve allegations that it failed to provide certified cost or pricing data when it negotiated rates with the Army Corps of Engineers for the repair and restoration of Puerto Rico’s power grid caused by a hurricane. According to the government’s complaint, the Army Corps of Engineers paid inflated rates for labor, equipment and basecamp services due the alleged violations of the Truth in Negotiations Act.

In a separate action, seven South Korea-based companies agreed to pay $3.1 million to resolve allegations they engaged in a bid-rigging conspiracy involving construction and engineering contracts for U.S. military bases in South Korea. According to the government’s allegations, the companies conspired to suppress and eliminate competition during the bidding process on 15 contracts which caused the Army Corps of Engineers to pay substantially more than if there been competitive bidding.

In another case, an Aircraft Parts Foundry agreed to pay $500,000 to resolve allegations that it failed to preform contractually required testing and falsified test results for parts used in military aircrafts. According to the complaint allegations, the company failed to perform the required metallurgic tests on large metal castings that it supplied to prime defense contractors, including Bell Helicopter, Sikorsky Aircraft and Boeing. The amount of the settlement was based on the company’s ability to pay.

To the surprise of no one, a significant portion of the $5 trillion spent by the government on COVID stimulus was lost to illicit schemes and fraud. The Small Business Administration’s Office of Inspector General has identified more than 70,000 loans totaling over $4.6 billion that potentially involve fraud.

DOJ has pursued a number of cases involving improper payments under the Paycheck Protection Program (PPP), including borrowers that improperly received duplicate or inflated loans or were otherwise ineligible for a PPP loan. In FY 2022, DOJ recovered over $6.8 million by resolving 35 separate actions brough under the False Claims Act.

In addition to borrowers, DOJ also brought an action against a lender that allegedly made a PPP loan to an applicant that it knew was ineligible. According to the allegations, the bank knew that the sole owner of a medical practice was facing criminal charges for prescribing opioids at the time he applied for the loan.

Another case involved the misuse other pandemic-related resources. A Florida-based not-for-profit corporation paid $1.75 million to resolve allegations that it arranged for hundreds of ineligible individuals to receive COVID-19 vaccinations, including the corporation’s board members; donors and potential donors; and 300 other ineligible individuals who were invited by the Vice Chairman of the Board of Directors and his brother.

Customs Fraud – two New York based apparel companies, and their owner, agreed to pay $6 million to settle civil fraud claims brought under the False Claims Act. The two clothing companies engaged in double invoicing schemes in which they fraudulently underreported the value of goods that were imported from China. As a result of their fraud, the companies avoided paying millions of dollars in customs duties for more than a decade. The owner of the company pled guilty for his role in the fraud and was sentenced to six months in prison. In addition to the False Claims Act settlement, the owner was ordered to forfeit $1.6 million in the criminal proceedings. The anonymous whistleblower who filed the qui tam complaint was awarded more than $1.2million from the recovered proceeds.

Education Fraud – a New Jersy based educational services provider agreed to pay $1.1 million to resolve False Claims Act allegations that it fraudulently obtained federal funds for afterschool tutoring services that it never provided. The program was intended to help underprivileged school students in the New York City public school system. The program was funded entirely by the U.S. Department of Education through grants to the New York City Department of Education, and the provider was paid $72.80 per hour for each student that it tutored.

Under the terms of its contract, the company was required to certify the truthfulness and accuracy of its attendance records. When the company allegedly submitted false certifications of its attendance records as part of its requests for payment, it allegedly resulted in False Claims Act violations. The government only became aware of the alleged fraud after a whistleblower had filed a qui tam complaint.

Mortgage Fraud – a mortgage company agreed to pay $24.9 million to resolve allegations that it violated the False Claims Act by knowingly approving ineligible loans that later defaulted which resulted in mortgage insurance claims to the Federal Housing Administration (FHA). The company also allegedly failed to self-report deficient loans that it had identified and failed to comply with rules requiring quality control programs to prevent underwriting deficiencies. The whistleblower who reported the fraud was the former head of quality control for the company. He received a reward of nearly $5 million from the government’s recovery.

In late 2021, DOJ announced the start of its Civil Cyber-Fraud Initiative which will hold accountable anyone that engages in fraud that places the government’s highly sensitive information and systems at risk.

DOJ intends to pursue contractors and grant recipients that provide deficient cybersecurity products or services; misrepresent their cybersecurity practices or protocols; or violate their obligations to monitor and report cybersecurity incidents and breaches. False Claims Act violations could potentially arise from the government’s procurement of information technology, software, and cloud-based storage.

One of the benefits of the Cyber-Fraud Initiative cited by DOJ is obtaining reimbursement for the government and taxpayers when losses result from a company’s failure to meet their cybersecurity obligations. The DOJ has made clear that it intends to utilize the False Claims Act in furtherance of this objective.

Retaliation Protections Under the False Claims Act

When a whistleblower files a qui tam lawsuit against their employer, the False Claims Act can provide protection from employer retaliation. The anti-retaliation provisions of the False Claims Act prohibit adverse changes to the terms and conditions of a whistleblower’s employment because of lawful activities undertaken by the whistleblower to prevent a violation of the False Claims Act.

If an employee is subjected to discriminatory action as a result of their status as a whistleblower, that employee is entitled to bring a cause of action for damages, including double back pay, interest, and compensation for special damages (e.g., litigation costs, attorneys’ fees, and certain non-economic injuries). The anti-retaliation provisions of the False Claims Act protect whistleblowers for three years from the date of retaliation. Other laws, such as state and municipal false claims act statutes, may provide additional protections from employer retaliation.

Confidentiality Under the False Claims Act

While the DOJ covertly investigates allegations of fraud during the period when the complaint is under seal, the identity of the whistleblower is known only to government investigators and, in certain cases, the Court. During this seal period, the whistleblower must maintain strict confidentiality regarding all aspects the qui tam lawsuit. After the government completes its investigation and notifies the court of its decision to intervene in the case, the complaint is unsealed, and the identity of the whistleblower becomes public knowledge in most cases.

If you have evidence of fraud involving any of the following areas, contact our team of experienced attorneys for a free, no obligation consultation.

False Claims Act FAQ

Qui tam is abbreviated from the Latin phrase, qui tam pro domino rege quam pro sic ipso in hoc parte sequitur, which means “who as well for the king as for himself sues in this matter.” A qui tam action allows a private citizen to file a lawsuit on behalf of the United States government. A whistleblower who brings a qui tam action that results in a judgment or settlement in is entitled to a percentage of the monetary recovery as a reward for exposing the fraud.

“Relator” is the term that refers to a whistleblower or qui tam plaintiff in an action brought under the False Claims Act.

Yes, a whistleblower must be represented by an attorney to file a qui tam action under the False Claims Act. To fully protect your interests in this specialized and complex area of the law, it is critical to select an established law firm with significant experience in False Claims Act litigation.

A Disclosure Statement is a document that contains substantially all the evidence in the relator’s possession supporting the allegations in the qui tam complaint. Although the disclosure statement is not filed with the Court, it must be served on the Department of Justice along with a copy of the qui tam complaint.

The success rate of qui tam actions where the government has intervened has historically been higher than in cases where the government has declined intervention. However, the government’s nonintervention doesn’t mean a qui tam action is destined for failure. The reality is that the government declines to intervene in most cases. Nevertheless, some of the largest civil settlements in qui tam actions have occurred in cases where the government did not intervene.

Yes, the False Claims Act requires that the Department of Justice investigate allegations of False Claims Act violations. The government’s investigation often involves one or more law enforcement agencies. In cases where a state agency is also the victim of fraud, the attorney general’s office from that state will often participate in the investigation and work closely with the federal agencies.

There are several possible scenarios. The DOJ can: (1) intervene in one or more counts of the qui tam complaint; (2) advise the relator and the court of its intention to decline intervention; (3) move to dismiss the relator’s complaint; (4) or settle the qui tam action with the defendant prior to intervention, or in conjunction with its intervention.

If the DOJ intervenes and obtains a monetary recovery through judgment or settlement, an eligible relator is entitled to receive 15% to 25% of the recovery. If the government declines to intervene, and the relator prosecutes the case without the government’s assistance, the range of the reward increases to 25% to 30% of the monetary recovery.

A false claim is a fraudulent request submitted to the United States government for payment of goods or services that were provided to, or on behalf of, the government. A “reverse” false claim is where an entity fails to pay, or otherwise satisfy, a financial obligation to the government.

A false claim can be made by one or more people, or most non-public entities or organizations, including corporations, educational institutions, and health care providers. Example of false claims include charging the government full price for a lesser quality or quantity of a contracted good or service, or submitting a claim for payment without delivering any good or service.

The False Claims Act protects the United States government. Since the treasury is directly funded by taxpayers, it is American taxpayers who are ultimately protected by the False Claims Act. Every dollar misappropriated by fraudsters is a dollar that isn’t available for important government expenditures, such as health care, education, or infrastructure.

In a larger sense, the False Claims Act protects every American who relies on goods and services for their welfare and protection. From lifesaving drugs and medical devices to ammunition and fighter planes, countless lives depend on the honesty and integrity of the companies and their employees who produce, repair, and maintain critical goods and services.

In Fiscal Year 2021, the Department of Justice recovered over $5.6 billion in settlements and judgments from civil cases brought under the False Claims Act. Since 1986, when the damages and penalties for False Claims Act violations were significantly increased, the federal government has recovered more than $70 billion.

Although the False Claim Act allows relators to file and prosecute a qui tam action, even after the government declines to intervene in the case, a relator must be represented by an attorney. To ensure the greatest chance of success, it is critical to choose an experienced law firm with an established track record of proven results in litigating False Claims Act cases.

Health Care and Pharmaceutical Manufacturing – fraud in the healthcare sector unquestionably accounts for the largest share of recoveries in False Claims Act cases. In FY 2022, over $1.7 billion of the more than $2.2 billion recovered by the Department of Justice involved the healthcare industry, including pharmaceutical and medical device manufacturers, managed care providers, hospitals, pharmacies, hospice organizations, laboratories, and physicians. Within the category of healthcare fraud, the pharmaceutical industry often ranks as the largest single contributor to amounts recovered through False Claims Act settlements and judgements. In FY 2022, settlements with prescription opioid manufacturers were a major contributor to the total amounts recovered.

Government Contracting and Procurement – procurement fraud involving the Department of Defense and other federal agencies ranks behind healthcare fraud as the second largest category of False Claim Act recoveries. In FY 2022, the federal government spent over $789 billion on national defense. The Department of Defense estimated that it paid over $2 billion in improper and unknown payments during the fiscal year. There are numerous opportunities for dishonest contractors to defraud the government in their quest for higher profits. Some of the most common schemes include bribery and kickbacks, bid rigging, improper substitution of products or services, and billing for unallowable costs. In FY 2022, DOJ reported that settlements and judgments in qui tam cases involving the Department of Defense totaled nearly $59 million.

Other Fraud (Non-HHS or DoD) – since healthcare and procurement fraud typically account for the largest percentage of annual False Claims Act recoveries, DOJ created a catch-all “other” category comprised of recoveries that does not include the Department of Health and Human Services and the Department of Defense. The “other” category includes fraud recoveries involving government-backed mortgages; imports and customs; research grants; student loans; and economic relief for COVID-19. In FY 2022, the government recovered over $251 million in Non-HHS/Non-DoD qui tam cases.

In the health care industry, False Claims Act violations often involve improper or fraudulent billing for medical services.

- Upcoding – submitting claims to government-funded health care programs using billing codes for more expensive services or procedures than what were actually rendered to the patient.

- Unbundling – billing for separate medical procedures or services that should have been billed as a single charge.

- Not Medically Necessary/Not Delivered – submitting claims for health care services, diagnostic tests, medical devices, or drugs that either lacked any legitimate medical purpose or were never provided to the patient.

- Stark Law Violations – physicians are prohibited from referring patients to a medical service provider, such as a laboratory or diagnostic test facility, where the physician, or an immediate family member, has a financial relationship.

- The Anti-Kickback Statute – a criminal law that prohibits physicians from receiving incentives to induce or reward them for referring patients for medical services paid by a federally funded health care program, such as Medicare or Medicaid. The statute imposes liability on those who offer such illegal incentives, as well as those who accept them. A claim submitted to the government involving a violation of the Anti-Kickback Statute can create liability under the False Claims Act.

False Claims Act violations involving drug manufacturers, pharmacy benefit managers, and pharmacies include misconduct relating to sales and marketing, price reporting, manufacturing, and billing.

- PBM Fraud – employers and health plan sponsors contract with Pharmacy Benefit Managers (PBMs) to design and administer prescription drug plans for their employees and members. PBMs have been sued for failing to accurately report pharmacy expenditures and discounts; not disclosing rebates and kickbacks; misrepresentations to patients, providers, and health care plans to obtain business; and charging copays that exceed the full cost of a drug.

- Price Reporting Fraud – in order to have their drugs covered by Medicaid, drug companies must agree to pay rebates to the states for each covered drug. The government uses a formula, based primarily on the prices reported by drug companies, to determine the amount of the rebate. By knowingly providing false pricing information, drug companies can significantly reduce the amount they pay as a rebate for a particular drug.

- Compounding Drug Fraud – when a particular combination of active ingredients is not available as a manufactured drug, pharmacists are permitted to create new mixtures of drugs, known as compounds. Compounding pharmacies have been found liable for misconduct involving drug formulations designed to ensure the highest possible reimbursement; targeting patients without regard to their actual needs; and producing compounded drugs that exceed allowable quantities.

- cGMP Fraud – Current Good Manufacturing Practice (“cGMP”) regulations impose minimum standards for the methods, facilities, and controls used to manufacture, process and package prescription drugs. To reduce costs, some drug manufacturing facilities cut corners in violation of cGMP requirements. Noncompliant facilities are much more likely to produce substandard, contaminated, or ineffective drug products.

Government contracting and procurement fraud involving the Department of Defense and other federal agencies can occur at any point in the process, from the pre-award phase through final completion of the contact.

- Bid Rigging – any conduct that interferes with the competitive bidding process. In its simplest form, bid rigging is a conspiracy among bidders to decide which company will submit the winning bid. Bid rigging schemes restrict competition and cause the government to unknowingly pay higher prices for goods and services.

- PRC Violations – most GSA contracts contain a Price Reduction Clause that is triggered whenever a government supplier revises its commercial price list or offers more favorable pricing, discounts, or terms to a commercial customer. In such instances, the government supplier must offer the same reduced price, discount, or terms to the government. A company that intentionally fails to disclose a PRC disturbance to the government can face liability under the False Claims Act.

- Bribery & Kickbacks – a bribe is anything of value offered to a public official to influence that official’s actions. A kickback is similar to a bribe, but the Anti-Kickback Act of 1986 requires that the kickback must be for the purpose of improperly obtaining or rewarding favorable treatment. Kickbacks to prime contractors and their employees, as well as subcontractors and their employees, is prohibited.

Civil penalties and damages for False Claims Act violations can be extremely onerous. The government is entitled to recover treble damages (triple the amount of its actual loss) as a result of a false claim. In addition to treble damages, each separate False Claims Act violation can result in a penalty of between $13,508 and $27,018, as adjusted for inflation in 2023.

The False Claims Act also allows a successful whistleblower to “receive an amount for reasonable expenses which the court finds to have been necessarily incurred, plus reasonable attorneys’ fees and costs. All such expenses, fees, and costs shall be awarded against the defendant.”

Yes, the False Claims Act contains provisions that specifically protect whistleblowers from retaliation by their employers. Retaliation is broadly defined to include any employee, contractor, or agent that has been “discharged, demoted, suspended, threatened, harassed, or in any other manner discriminated against in the terms and conditions of employment . . . because of lawful acts done . . . to stop 1 or more violations of the Act.”

A retaliation claim brought under the False Claims Act must be filed within 3 years of the date when the retaliation occurred. An employee who prevails in a retaliation action can receive: (i) reinstatement with the same seniority status; (ii) two times the amount of back pay, with interest; and (iii) compensation for special damages, including litigation costs, reasonable attorneys’ fees, emotional distress, and other non-economic damages caused by the retaliation.

In its simplest terms, a false claim is any attempt to receive payment from, or withhold payment to, the United States government through fraudulent or deceptive means. The False Claims Act specifies the conduct and circumstances that constitute false claims. The statute imposes liability for any person who:

(A) knowingly presents, or causes to be presented, a false or fraudulent claim for payment or approval;

(B) knowingly makes, uses, or causes to be made or used, a false record or statement material to a false or fraudulent claim;

(C) conspires to commit a violation of subparagraph (A), (B), (D), (E), (F), or (G);

(D) has possession, custody, or control of property or money used, or to be used, by the Government and knowingly delivers, or causes to be delivered, less than all of that money or property;

(E) is authorized to make or deliver a document certifying receipt of property used, or to be used, by the Government and, intending to defraud the Government, makes or delivers the receipt without completely knowing that the information on the receipt is true;

(F) knowingly buys, or receives as a pledge of an obligation or debt, public property from an officer or employee of the Government, or a member of the Armed Forces, who lawfully may not sell or pledge property; or

(G) knowingly makes, uses, or causes to be made or used, a false record or statement material to an obligation to pay or transmit money or property to the Government, or knowingly conceals or knowingly and improperly avoids or decreases an obligation to pay or transmit money or property to the Government[.]

31 U.S.C. § 3729 (a)(1)(A)-(G).

Intent is a critical consideration when analyzing liability under the False Claims Act. A person must act “knowingly” to be liable under the False Claims Act. “Knowingly” means that a person had actual knowledge of specific information and acted in deliberate ignorance of whether the information was true or false, or acted in reckless disregard of whether the information was true or false. Importantly, there is no requirement to prove that a person acted with specific intent to defraud the government.

In FY 2022, the United States government spent $6.27 trillion. The largest expenditures were on:

Social Security | $1.22 trillion | 19% |

Health | $914 billion | 15% |

Income Security | $865 billion | 14% |

National Defense | $767 billion | 12% |

Medicare | $755 billion | 12% |

Education, Training, Employment & Social Services | $677 billion | 11% |

Net Interest | $475 billion | 8% |

Veterans Benefits & Services | $274 billion | 4% |

Transportation | $132 billion | 2% |

General Government | $129 billion | 2% |

Other | $65 billion | 1% |

The table below shows the amount spent by each federal agency in FY 2022.

Department of Health and Human Services | 26% |

Social Security Administration | 20% |

Department of the Treasury | 19% |

Department of Defense – Military Programs | 12% |

Department of Education | 10% |

Department of Veterans Affairs | 4% |

Department of Agriculture | 4% |

Department of Transportation | 2% |

Office of Personnel Management | 2% |

Department of Homeland Security | 1% |

The government lacks the capacity or resources to audit every contract or review every suspicious Medicare payment request. Whistleblowers are an essential element in identifying misconduct and reclaiming a percentage of the billions lost annually to fraudsters and criminals.

The qui tam provisions of the False Claim Act allow a private individual or entity, known as a relator, to file a lawsuit on behalf of the United States government. In 1986, the False Claims Act was amended to significantly increase the damages and penalties for violations. From 1986 through 2021, the federal government has recovered more than $70 billion in judgments and settlements — more than 72% of that amount came from qui tam lawsuits filed by whistleblowers. Since 1986, the federal government has paid over $7.8 billion in statutory rewards to successful whistleblowers.

States False Claims Acts

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| None, but Ark. Code § 20-77-911 allows for a discretionary award of up to 10% of any civil recovery for information provided. |

None |

Limited to Medicaid-related claims. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Cal. Gov. Code § 12651 | Cal. Gov. Code § 12652 | Cal. Gov. Code § 12653 |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Limited to Medicaid-related claims. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Effective March 16, 2021, the District’s False Claim Act allows claims for tax violations. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

|

Ga. Code § 23-3-121 (TPA) Ga. Code § 49-4-168.1 (FMCA) |

Ga. Code § 23-3-122 (TPA) Ga. Code § 49-4-168.2 (FMCA) |

Ga. Code § 23-3-122 (TPA) Ga. Code § 49-4-168.4 (FMCA) |

Georgia has two false claims acts: the Taxpayer Protection Act (TPA) and the False Medicaid Claims Act (FMCA). |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

|

Haw. Rev. Stat. § 661-21 (FCA) Haw. Rev. Stat. § 46-171 (CFCA) |

Haw. Rev. Stat. § 661-25 (FCA) Haw. Rev. Stat. § 46-175 (CFCA) |

Haw. Rev. Stat. § 661-30 (FCA) Haw. Rev. Stat. § 46-180 (CFCA) |

Hawaii has a state false claims act (FCA) and a corresponding statute applicable to its counties (CFCA). |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Illinois’ False Claims Act allows claims for tax violations except for those covered under the Illinois Income Tax Act. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

|

Ind. Code § 5-11-5.5-2 (FCWPA) Ind. Code § 5-11-5.7-2 (MFCWPA) |

Ind. Code § 5-11-5.5-4 (FCWPA) Ind. Code § 5-11-5.7-4 (MFCWPA) |

Ind. Code § 5-11-5.5-8 (FCWPA) Ind. Code § 5-11-5.7-8 (MFCWPA) |

Indiana has two false claims acts: the False Claims and Whistleblower Protection Act (FCWPA) and Medicaid False Claims and Whistleblower Protection Act (MFCWPA). |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Limited to Medicaid-related claims. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Md. Code, Gen. Provisions § 8-102 (FCA) Md. Code, Health-Gen. § 2-602 (FHCA) Md. Code, Tax-Gen. § 1-402 (WRP) | Md. Code, Gen. Provisions § 8-104 (FCA) Md. Code, Health-Gen. § 2-604 (FHCA) Md. Code, Tax-Gen. § 1-402 (WRP) | Md. Code, Gen. Provisions § 8-107 (FCA) Md. Code, Health-Gen. § 2-607 (FHCA) Md. Code, Tax-Gen. § 1-405 (WRP) | Maryland has three false claims acts: the False Claims Act (FCA); the False Health Claims Act (FHCA); and the Whistleblower Reward Program (WRP). The WRP applies to tax violations. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| None, but Mo. Rev. Stat. § 191.907 provides for a mandatory reward of 10% of any civil recovery for information provided. | Limited to Medicaid and healthcare-related claims. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Limited to claims against companies based in New Hampshire or claims involving reimbursements from Medicaid with the prior year. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

|

N.M. Stat. § 27-14-4 (MFCA) N.M. Stat. § 44-9-3 (FATA) |

N.M. Stat. § 27-14-7 (MFCA) N.M. Stat. § 44-9-5 (FATA) |

N.M. Stat. § 27-14-12 (MFCA) N.M. Stat. § 44-9-11 (FATA) |

New Mexico has two false claims acts: the Medicaid False Claims Act (MFCA) and the Fraud Against Taxpayers Act (FATA). |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| The New York False Claims Act also allows claims based on tax violations. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Limited to Medicaid-related claims. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

|

Tenn. Code § 4-18-103 (FCA) Tenn. Code § 71-5-182 (MFCA) |

Tenn. Code § 4-18-104 (FCA) Tenn. Code § 71-5-183 (MFCA) |

Tenn. Code § 4-18-105 (FCA) Tenn. Code § 71-5-183 (MFCA) |

Tennessee has two false claims acts: the False Claims Act (FCA) and the Medicaid False Claims Act (MFCA). |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

|

Tex. Hum. Res. Code § 36.002 (TMFPA) The TWA waives sovereign immunity whenever a public employee alleges a violation of Chapter 554 of the Texas Gov’t Code. |

Tex. Hum. Res. Code § 36.101 (TMFPA) The TWA does not have a qui tam provision. It provides relief for public employees who were subject to retaliation for reporting a violation by the agency that employs them. |

Tex. Hum. Res. Code § 36.115 (TMFPA) Tex. Gov’t Code § 554.002 (TWA) |

Texas has two false claims acts: the Texas Medicaid Fraud Prevention Act (TMFPA) and the Texas Whistleblower Act (TWA). The TWA only applies to state public employees. |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Civil FCA | Qui Tam Provision | Anti-Retaliation Provision | Notes |

| Limited to Medicaid-related claims. |

Practice Areas

- False Claims Act

- Contractors and Sub-Contractors Fraud under the Davis-Bacon Act

- Customs Fraud

- Education Fraud Under the False Claims Act

- Finance Industry Whistleblowers

- Empowering Environmental Whistleblowers for a Greener Future

- Government-backed Mortgage Fraud

- Safeguard Your Business from Procurement Fraud Risks

- Whistleblowing in Healthcare under the False Claims Act

- Nuclear Safety Whistleblowers

- Pharmaceutical Whistleblowers

- Small Business Contract Fraud Under The False Claims Act

- Transportation Whistleblowers

- SEC Whistleblower Program

- CFTC Whistleblower Program

- FIRREA Whistleblowers

- IRS Whistleblower Program

- Auto Whistleblower Program

- Class Actions

- Executive Compensation and Employment Law