The U.S. Securities and Exchange Commission (SEC) recently announced an extraordinary milestone in its efforts to encourage whistleblowers and uphold market integrity. In a groundbreaking decision, the SEC awarded over $98 million to two whistleblowers whose tips and subsequent cooperation were instrumental in leading to significant enforcement actions against violators of federal securities laws. This award is among the highest ever granted by the SEC under its whistleblower program, underscoring the crucial role whistleblowers play in uncovering wrongdoing and protecting investors.

The Role of Whistleblowers in SEC Enforcement

The SEC’s whistleblower program, established under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, has been a powerful tool in detecting securities fraud. Whistleblowers provide the SEC with original, timely, and credible information that can lead to successful enforcement actions, protecting investors and promoting market transparency. The program incentivizes individuals to come forward with knowledge of potential securities law violations by offering monetary awards and robust anti-retaliation protections.

Since its inception, the SEC whistleblower program has awarded more than $1.7 billion to over 550 individuals whose information and assistance have contributed to the success of enforcement actions, resulting in orders for wrongdoers to pay billions of dollars in penalties, disgorgement, and interest. The SEC whistleblower award not only aids in recovering substantial amounts for harmed investors but also serves as a deterrent against future misconduct.

Details of the $98 Million SEC Whistleblower Award

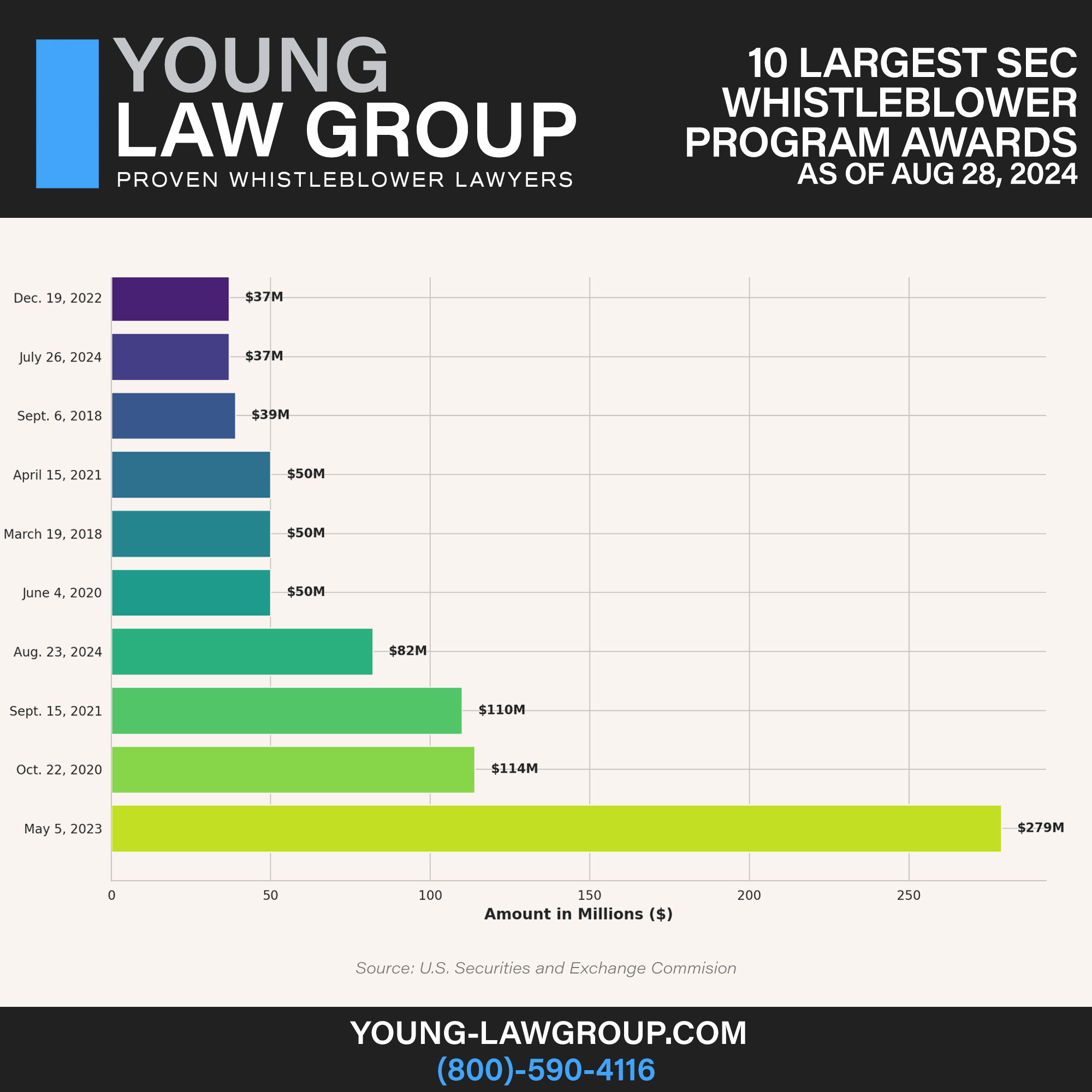

The recent SEC whistleblower award totaling $98 million marks a significant achievement in the SEC’s enforcement efforts. According to the SEC’s press release, one whistleblower received an impressive $82 million, making it one of the largest individual awards in the program’s history. This whistleblower’s information was critical in initiating the SEC’s investigation and was supplemented with ongoing assistance throughout the investigation, including participating in interviews and providing additional documentation, which proved crucial in uncovering the extent of the misconduct.

The second whistleblower was awarded $16 million. While their information came after the SEC had already opened the investigation, it provided a new and detailed analysis of complex issues, contributing additional evidence that significantly impacted the case’s outcome. This underscores the importance of whistleblowers providing unique perspectives or information, even when investigations are already underway.

These SEC whistleblower awards are paid from an investor protection fund established by Congress, which is financed entirely through monetary sanctions paid to the SEC by securities law violators. No funds are taken or withheld from harmed investors to pay whistleblower awards. This funding model ensures that the whistleblower program is self-sustaining and does not reduce the compensation available to those who have suffered financial harm due to securities violations.

Implications for Future Whistleblowers

The substantial SEC whistleblower awards given to these two individuals illustrate the SEC’s commitment to rewarding those who provide valuable information. The SEC’s program offers anonymity to whistleblowers, a critical feature for anyone fearing retaliation or professional consequences. The SEC protects whistleblower identities by keeping their information confidential to the fullest extent possible under the law. Additionally, whistleblowers benefit from anti-retaliation provisions, which prohibit employers from firing, demoting, suspending, threatening, harassing, or discriminating against them for reporting misconduct.

The SEC’s Office of the Whistleblower has experienced a steady increase in the number of tips received annually, reflecting growing awareness and confidence in the SEC whistleblower award program. The office processes thousands of tips each year, thoroughly evaluating each one to determine its potential for enforcement action. This influx of information is vital for the SEC to identify and address complex schemes and frauds that may otherwise go undetected.

Encouraging a Culture of Compliance

The substantial awards given in this case, particularly the SEC whistleblower award, send a clear message to corporations and individuals about the importance of fostering a culture of compliance. Companies are encouraged to implement robust internal reporting mechanisms and ensure that employees feel secure in reporting potential misconduct without fear of retaliation. A strong culture of compliance can prevent misconduct from occurring in the first place and minimize the impact when issues do arise.

The SEC’s whistleblower program plays a crucial role in upholding the integrity of the financial markets. By empowering individuals to come forward with critical information and providing significant financial incentives, the SEC is better positioned to detect and deter misconduct. The recent awards totaling $98 million, part of the SEC whistleblower award system, are a testament to the bravery of whistleblowers and the effectiveness of the program in protecting investors and maintaining fair and transparent markets.

Conclusion

The SEC’s decision to award nearly $100 million to two whistleblowers underscores the critical role that individuals play in safeguarding the financial markets. Whistleblowers who provide valuable information and cooperate with regulatory authorities are key allies in the fight against fraud and misconduct. These substantial SEC whistleblower awards serve to encourage more individuals to step forward, reinforcing the SEC’s commitment to protecting investors and ensuring that securities laws are upheld. For potential whistleblowers, this case illustrates that their actions can lead to significant financial rewards while contributing to the greater good of maintaining market integrity.